Last week, a crypto exchange Kraken had to shut down its staking-as-a-service product in the US and pay $30M in penalties for failing to register it with the SEC as a security. These actions against staking raise a big concern in the crypto community. But what is staking and why should we care about these news?

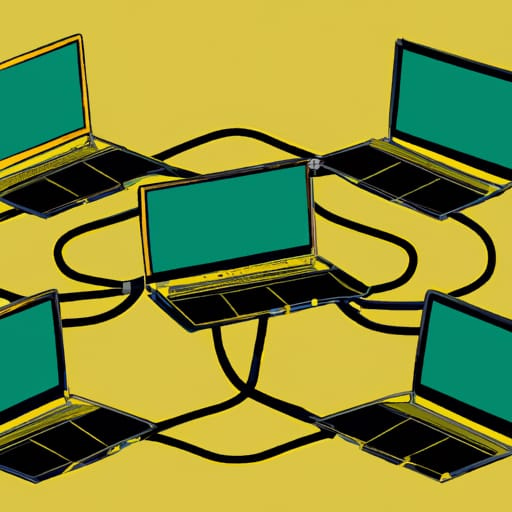

While we depend on banks to verify and settle our financial transactions, blockchains use a distributed network of computers to do that. Anybody can be part of the network. If I want to verify transactions on Ethereum today, I need to have a decent computer and 'stake' 32 ETH to become a network validator. The Ethereum network then randomly chooses validators and once transactions are verified, rewards them with more ETH. By 'staking' my ETH I'm committing money and computing resources to verify transactions. If I verify honestly, I will get rewarded with tokens. If I lie and process false transactions, my staked coins will be taken away. Staking is a mechanism to make sure everybody is playing by the rules.

But let's be honest, as an individual it's hard for me to be a validator. First, I need to have a dedicated computer running at all times but most importantly I need to have 32 ETH (equivalent to $54,000). Which I don't have. Instead, I can use staking-as-a-service products by Coinbase, Lido, or previously Kraken to stake the 1-2 ETH that I have and earn 4-7% interest annually.

The SEC going after staking-as-a-service platforms limits the ability for consumers to participate in the network and get rewarded for it. How this story develops is going to have a big impact on crypto.

Discussion about this post

No posts